India’s Startup Funding Jumps Around 668% in a Week, Led by AI and Climate Tech Bets

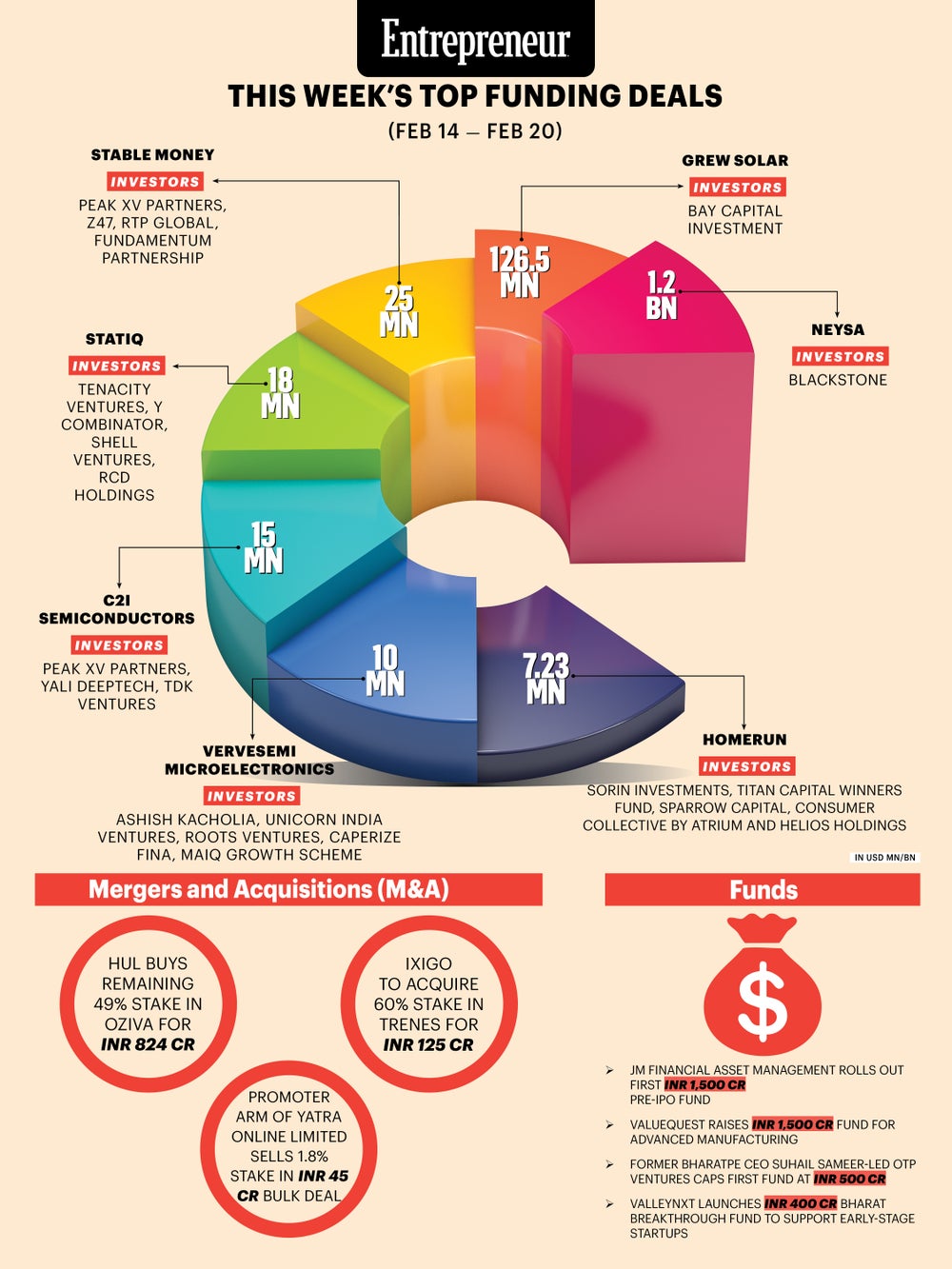

This Week’s Top Funding Deals (Feb 14–20): Neysa and GREW Solar Lead Big Bets

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

India’s startup funding momentum rebounded sharply this week, with total investments rising nearly 668 percent compared with Feb 6–12, 2026, according to Tracxn.

The surge reflects renewed investor confidence across deeptech, climate tech, fintech, and infrastructure enablers. Large-ticket investments in AI infrastructure and renewable energy manufacturing led the week, while semiconductor innovation and EV charging networks continued attracting strategic capital.

Top Funding Deals

Neysa (AI Infrastructure & Cloud)

Mumbai-based Neysa builds an AI acceleration cloud platform that helps enterprises develop and deploy generative AI applications securely and cost-effectively. Its GPU-as-a-Service platform enables high-performance computing access, while AI-native consulting, observability, and security tools support end-to-end AI workflow deployment across industries.

• Inception: 2023

• Headquartered: Mumbai

• Founders: Sharad Sanghi, Anindya Das

• Funding Amount: USD 1.2 Billion (USD 600 Million initial infusion; remaining committed for phased deployment)

• Investors: Blackstone

GREW Solar (Renewable Energy Manufacturing)

GREW Solar manufactures high-efficiency M10 TOPCon solar PV modules and is expanding integrated solar production capacity. Operating a 3 GW facility in Rajasthan, the company aims to strengthen India’s solar value chain through advanced module manufacturing and expansion into upstream and downstream solar solutions.

• Inception: 2022

• Headquartered: Dudu (Rajasthan)

• Founders: Chiripal Group; CEO Vinay Thadani

• Funding Amount: USD 126.5 Million

• Investors: Bay Capital Investment

Stable Money (Fintech & Fixed-Income Investments)

Bengaluru-based Stable Money offers a digital platform for fixed-income investing, enabling users to access fixed deposits, bonds, and low-risk instruments. The platform allows individuals to compare rates, invest, and manage predictable-return products designed to deliver safe, inflation-beating returns.

• Inception: 2022

• Headquartered: Bengaluru

• Founders: Saurabh Jain, Harish Reddy

• Funding Amount: USD 25 Million

• Investors: Peak XV Partners, RTP Global, Fundamentum Partnership, Z47

Statiq (EV Charging Infrastructure)

Statiq builds and operates EV charging infrastructure and provides a mobile app for locating and booking charging points. With over 10,000 chargers across nearly 100 cities, the company offers hardware, software, and financing solutions to accelerate EV adoption and infrastructure deployment.

• Inception: 2020

• Headquartered: Gurugram

• Founders: Akshit Bansal, Raghav Arora

• Funding Amount: USD 18 Million

• Investors: Y Combinator, Shell Ventures, Tenacity Ventures, RCD Holdings

C2i Semiconductors (AI Power Management Chips)

C2i Semiconductors (AI Power Management Chips)

C2i Semiconductors develops intelligent power management ICs and architectures designed for AI data centers and cloud infrastructure. Its technology improves power density and reduces energy consumption from grid to processor core, supporting efficient next-generation computing.

• Inception: 2024

• Headquartered: Bengaluru

• Founders: Ram Anant, Vikram Gakhar, Preetam Tadeparthy, Dattatreya Suryanarayana, Harsha S B, Muthusubramanian N V

• Funding Amount: USD 15 Million

• Investors: Peak XV Partners, TDK Ventures, Yali Deeptech

Vervesemi Microelectronics (Semiconductor IP & IC Design)

Greater Noida-based Vervesemi Microelectronics develops high-performance analog and mixed-signal semiconductor IP and ICs for aerospace, defense, industrial automation, and smart energy applications. Its portfolio includes 140+ IP blocks and multiple patented technologies for global markets.

• Inception: 2017

• Headquartered: Greater Noida

• Founders: Rakesh Malik, Pratap Narayan Singh

• Funding Amount: USD 10 Million

• Investors: Unicorn India Ventures, Roots Ventures, Ashish Kacholia, Caperize Fina, MAIQ Growth Scheme

HomeRun (Construction Supply & Quick Commerce)

HomeRun delivers construction and renovation materials within 60–90 minutes through a tech-enabled retail network. Serving homeowners and contractors, the platform addresses supply delays and price opacity while ensuring timely access to essential project materials.

• Inception: 2024

• Headquartered: Bengaluru

• Founder: Pukhraj Grewal

• Funding Amount: USD 7.23 Million

• Investors: Titan Capital Winners Fund, Sorin Investments, Sparrow Capital, Consumer Collective by Atrium, Helios Holdings

Mergers & Acquisitions

In consolidation moves, Hindustan Unilever Limited acquired the remaining 49% stake in OZiva for INR 824 crore, strengthening its nutrition portfolio. Travel platform ixigo agreed to acquire a 60% stake in Trenes for INR 125 crore. Meanwhile, the promoter arm of Yatra Online Limited divested a 1.8% stake in a INR 45 crore bulk deal.

Fund Launches & Capital Pools

On the fund activity front, JM Financial Asset Management launched its first INR 1,500 crore pre-IPO fund. ValueQuest raised INR 1,500 crore for advanced manufacturing investments. OTP Ventures, led by former BharatPe CEO Suhail Sameer, closed its debut fund at INR 500 crore. ValleyNXT also introduced a INR 400 crore Bharat Breakthrough Fund focused on early-stage startups.

Overall, the week underscored strong investor appetite for AI infrastructure, climate tech, semiconductor innovation, and digital platforms addressing real-world inefficiencies.

India’s startup funding momentum rebounded sharply this week, with total investments rising nearly 668 percent compared with Feb 6–12, 2026, according to Tracxn.

The surge reflects renewed investor confidence across deeptech, climate tech, fintech, and infrastructure enablers. Large-ticket investments in AI infrastructure and renewable energy manufacturing led the week, while semiconductor innovation and EV charging networks continued attracting strategic capital.

Top Funding Deals

Neysa (AI Infrastructure & Cloud)

Mumbai-based Neysa builds an AI acceleration cloud platform that helps enterprises develop and deploy generative AI applications securely and cost-effectively. Its GPU-as-a-Service platform enables high-performance computing access, while AI-native consulting, observability, and security tools support end-to-end AI workflow deployment across industries.