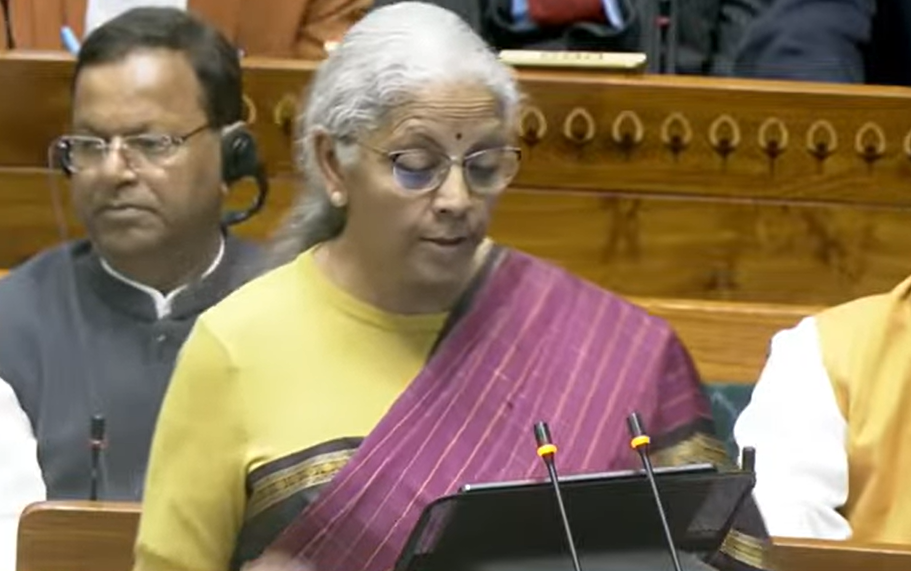

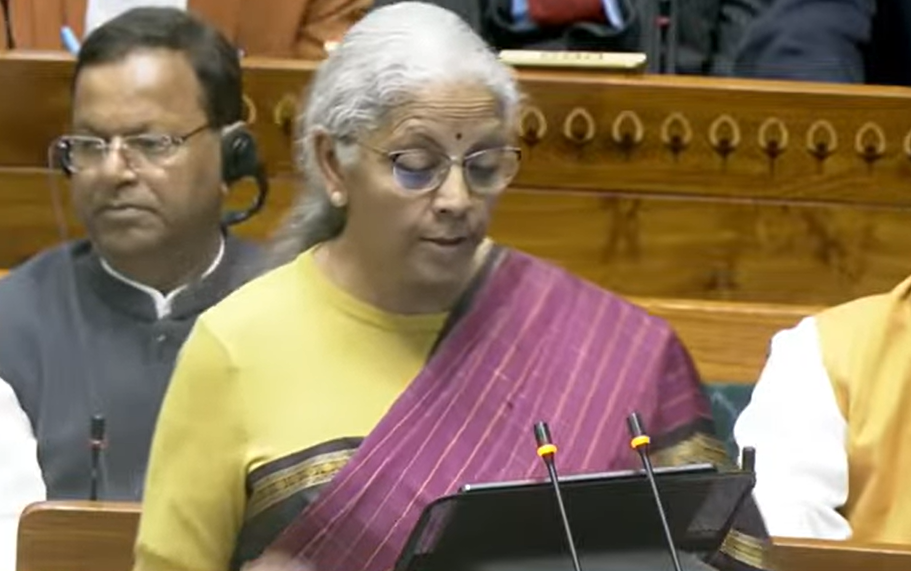

Budget 2026: FM Nirmala Sitharaman Proposes INR 10,000 Crore SME Growth Fund

Finance Minister Nirmala Sitharaman used the Budget to sharpen the government’s push for India’s small businesses, announcing a mix of fresh funding, cluster revival, and tighter credit linkages aimed at strengthening the MSME backbone.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

Finance Minister Nirmala Sitharaman used the Budget to sharpen the government’s push for India’s small businesses, announcing a mix of fresh funding, cluster revival, and tighter credit linkages aimed at strengthening the MSME backbone. Together, the measures signal a reset in how small and medium enterprises access capital, markets, and receivables.

At the core of the plan is a scheme to revive 200 legacy industry clusters, focusing on traditional manufacturing hubs that have withered under credit stress and outdated technology. The initiative is intended to regenerate employment and bring long-neglected production zones back into the economic mainstream.

The Budget also proposes an INR 10,000 crore SME Growth Fund to help scale high-potential firms. The fund will be complemented by incentive frameworks that reward enterprises meeting benchmarks such as higher productivity, greater formalisation, and export readiness.

For the smallest businesses, the Self-Reliant India Fund will receive an INR 2,000 crore infusion, aimed at supporting micro enterprises that continue to struggle for capital despite the presence of credit guarantee schemes.

Archana Jahagirdar, Founder & Managing Partner of Rukam Capital, said that MSMEs serve as a vital engine for growth.

“Initiatives like equity support through a dedicated INR 10,000 crore fund for future MSME champions, plus a INR 2,000 crore top-up to the Self-Reliant India Fund, empower entrepreneurs to invest in R&D and scale innovative products and services.vLiquidity measures-such as invoicing platforms, credit guarantees, and “Corporate Mitras” for compliance support- further catalyse the ecosystem,” said Jahagirdar.

The Finance Minister also noted that the next growth phase for MSMEs will emerge from tier-II and tier-III cities, positioning them as new engines of progress.

“These budget policies not only support but propel the Indian startup ecosystem, enabling businesses to thrive and innovate. In essence, by nurturing MSMEs, India is laying a robust foundation for inclusive, sustainable development,” added Jahagirdar.

Finance Minister Nirmala Sitharaman used the Budget to sharpen the government’s push for India’s small businesses, announcing a mix of fresh funding, cluster revival, and tighter credit linkages aimed at strengthening the MSME backbone. Together, the measures signal a reset in how small and medium enterprises access capital, markets, and receivables.

At the core of the plan is a scheme to revive 200 legacy industry clusters, focusing on traditional manufacturing hubs that have withered under credit stress and outdated technology. The initiative is intended to regenerate employment and bring long-neglected production zones back into the economic mainstream.

The Budget also proposes an INR 10,000 crore SME Growth Fund to help scale high-potential firms. The fund will be complemented by incentive frameworks that reward enterprises meeting benchmarks such as higher productivity, greater formalisation, and export readiness.