Understanding India’s Leverage in the US and EU Deals, Strategic Gains, and More

India looks to unlock $30-trillion US market for exports across key sectors but what are its leverages?

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

Late January, India and the European Union (EU) finalised a landmark Free Trade Agreement (FTA), also touted as the “mother of all deals.” And shortly after, India made the trade breakthrough with the United States (US) after months of back-and-forth of negotiations. These two deals together mark a seismic shift for the Indian economy as well as the global trade by creating a multi-trillion dollar economic vista.

India and EU FTA

Nearly a decade in the making, the India EU FTA brings an unprecedented market access for both the regions. The agreement brings the two markets much closer through tariff liberalisation, market access, and also sets a strong foundation for technological cooperation.

Some key things about the India-EU FTA.

– The EU is India’s one of the largest trading partners, with bilateral trade in goods and services growing steadily over the years.

In 2024–25, India’s bilateral trade in goods with the EU stood at INR 11.5 Lakh Crore (USD 136.54 billion) with exports worth INR 6.4 Lakh Crore (USD 75.85 billion) and imports amounting to INR 5.1 Lakh Crore (USD 60.68 billion).

India-EU trade in services reached INR 7.2 Lakh Crore (USD 83.10 billion) in 2024.

– India and the EU are 4th and 2nd largest economies, comprising 25% of Global GDP and account for one third of global trade. Integration of the two large diverse and complementary economies will create unprecedented trade and investment opportunities.

– India has gained preferential access to the European markets across 97% of tariff lines, covering 99.5% of trade value, while India is offering 92.1% of its tariff lines which covers 97.5% of the EU exports

ALSO READ: India-EU FTA Bets On AI, Quantum, and Advanced Semiconductors

The FTA is set to facilitate and unlock new opportunities between the two markets, especially for sectors that have remained under high tax regime. For instance, the auto sector will see India providing duty-free access to European markets and will attract European OEMs to invest further in India.

India has agreed to bring down tariffs on passenger cars from 110 per cent to 10 per cent over time. Most cars will initially move to a lower 30-35 percent tariff, which will further reduce to 10 percent over five to 10 years. Concessions in tariffs is agreed upon for 250,000 cars imported annually into India from the EU, a significant shift in India’s trade posturing. However, under the new trade deal, India can export 625,000 vehicles to the EU, as the EU’s car market is bigger.

ALSO READ: What the ‘Mother Of All’ Trade Deals Mean For Indian Auto Industry

In Focus: India-US FTA

Recently announced India-US bilateral trade agreement brings a sustained preferential access for Indian exports in the U.S. market valued at over USD 30 trillion. The agreement has tariff rationalisation, zero-duty access across large product categories, enhanced digital and technology cooperation, and a carefully calibrated framework to safeguard India’s farmers, MSMEs and domestic industry.

“With India’s total exports to the United States standing at USD 86.35 billion in 2024, the agreement significantly enhances competitive access across key sectors including textiles, leather, gems and jewellery, agriculture, machinery, home décor, pharmaceuticals, and technology-driven industries,” the Commerce and Industry Ministry said in a press release.

Key takeaways are

· India secured preferential access to a USD 30 trillion U.S. market

· Textiles & apparel gain tariff cuts from 50% to 18%, with silk securing 0% duty access in a USD 113 billion U.S. market

· Machinery exports see tariffs reduced to 18%, opening opportunities in a USD 477 billion U.S. market

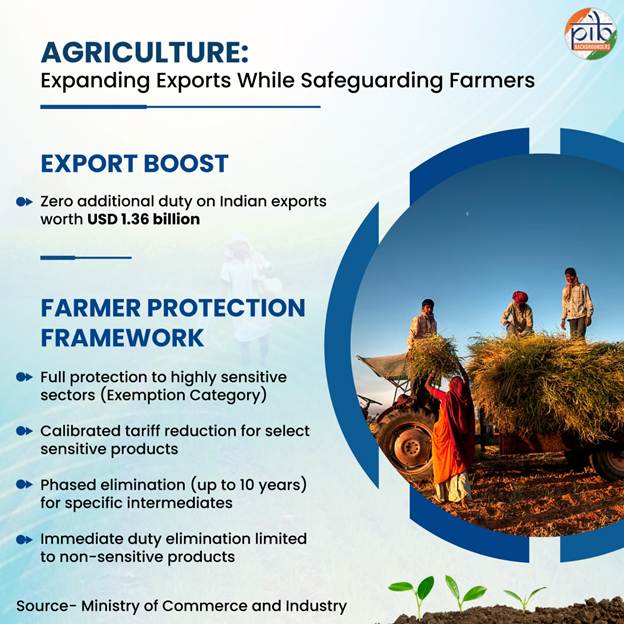

· USD 1.36 billion of Indian agricultural exports receive zero additional U.S. duty access

· Key products including spices, tea, coffee, fruits, nuts and processed foods gain zero-duty treatment

· Highly sensitive sectors such as dairy, meat, poultry and cereals remain fully protected

What does India get?

a. Highly competitive rate of 18% on $ 900 bn worth of global imports of the U.S.

b. Zero duty on $ 150 bn worth of global imports of the U.S.

c. No additional duty on $ 720 bn worth of global imports of the U.S.

d. Exemption continues $ 350 bn worth of global imports of the U.S.

e. Preferential treatment on 232 tariffs

You can learn more about the details of the US-India trade agreement here.

Safeguarding local interests

From India’s perspective, there’s been extensive focus on protecting the interests of local industries, small businesses, farmers, and much more. This is pretty much in line with the age-old position of India even with its markets opening up to the world nearly three decades ago.

For instance, the government maintains that it has opened up new export opportunities for the agriculture sector while protecting local farmers.

According to the government:

“The United States will apply zero additional duty on Indian exports worth USD 1.36 billion. Beneficiary products include spices; tea and coffee and their extracts; copra and coconut oil; vegetable wax; nuts such as areca nuts, Brazil nuts, cashew nuts and chestnuts; fruits and vegetables including avocados, bananas, guavas, mangoes, kiwis, papayas, pineapples shitake, and mushroom; cereals such as barley and canary seeds; bakery products; cocoa, and cocoa preparations; sesame and poppy seeds; and processed products such as fruit pulp, juices and jams.

Within this agricultural products valued at USD 1.035 billion have been assured zero Reciprocal Tariff to avoid uncertainty, providing stability and predictability to Indian farmers and exporters.”

It also appears that India has found some leverage in the process with the US revising its factsheet to drop claims that India would slash tariffs on “certain pulses.” It also revised language pertaining to the commitment of a $500 billion purchase from India.

Timeliness

It’s worth noting that the deals have come amid a complex global geopolitical situation. Trade deals give India a leverage on the global map. According to Moglix founder and CEO Rahul Garg, securing deeper and more stable access to these two large markets strengthens India’s position at a time when supply chains are being reconfigured and trade flows are increasingly shaped by geopolitics.

“In a fragmented global environment, structured engagement with rules based economies enhances India’s credibility as a long term manufacturing and services partner. It reinforces India’s role as a reliable bridge between Western demand and diversified Asian supply chains,” he said.

“Consider the India – US trade deal not just in context of India – US trade relationship, but rather a serendipitous event in India’s post-colonial history that will be a steppingstone to propel India towards Viksit Bharat by 2047.

Akshay Patel, Managing director at Sigma Terminals, adds that while India is amongst the top 5 GDPs and the fastest growing major economy housing 18% of world’s population, we only contribute to 2.5% of global trade. This indicates that there is a tremendous opportunity for growth once India starts to increase its integration with the global markets.

Leverage for Indian businesses

Experts believe that for Indian businesses, predictability is the biggest gain. When tariff regimes stabilise and preferential access expands, exporters can price with confidence and commit to multi-year contracts. In competitive sectors such as engineering goods or textiles, even a reduction of a few percentage points in duties can significantly improve margins and win rates.

Greater clarity also encourages investment in capacity, automation and compliance. This helps Indian firms integrate more deeply into global value chains rather than operating as transactional exporters. Over time, that shift supports higher value manufacturing and stronger export resilience.

Moreover, engineering goods and industrial manufacturing stand to benefit meaningfully. India is already a major exporter of auto components, electrical equipment and industrial machinery. More predictable access to US and EU markets enhances pricing stability and strengthens India’s position as an alternative sourcing destination as global firms diversify.

“Textiles and apparel are another important category. Historically, Indian exporters faced EU tariffs in the low to mid-teens, while some competitors enjoyed preferential access. A more level tariff structure narrows that gap and creates room to expand in higher value and sustainable segments within a European apparel market worth over $100 billion annually,” Garg said.

“Agro processing and value added food products can see selective gains where tariff rationalisation improves competitiveness, while electronics and advanced manufacturing benefit from reduced trade friction as India positions itself within diversified global production networks,” he added.

Patel further elaborates that India already benefits from strong demographics with a young population and high PPP (purchasing power parity) making the country cost competitive for global sourcing. As Indian manufacturers get deeper access to global markets, we will ultimately start reaping the benefits of our BCC (best cost country) status and grow our footprint in global supply chains.

As global investors see a promising growth story, big money is going to start flowing into manufacturing. This will help grow businesses further at every scale either directly or through trickle-down effect. This will ultimately also solve the age-old problem of export of Indian talent to foreign countries, as talent demand will grow domestically and employment opportunities will grow steadily.

Having said that, not everyone has fully welcomed the deal, specifically with the US. Opposition leader Rahul Gandhi has called the agreement unequal and that the US had more leverage by asking India to stop buying oil from Russia.

“The point is that I don’t believe that an Indian PM, including Mr Modi, would sign the (US-India) deal unless there was a chokehold on him,” Gandhi is quoted as saying.

Clearly, the conversation surrounding the trade deal is just beginning, as several key facets of the agreement have yet to be explored. The real test, however, will be how effectively these deals safeguard the interests of local industries.

Garg of Moglix notes that India’s strategy has been measured. Agriculture and dairy employ a large share of the population and remain politically and economically sensitive. Market opening in these areas has been approached cautiously, with safeguards and calibrated timelines where necessary.

“The broader objective is clear: expand opportunity where India has scale and competitiveness, while protecting vulnerable segments from abrupt disruption. If implemented thoughtfully, these trade frameworks can strengthen India’s external economic footprint without compromising domestic stability,” he explained.

Late January, India and the European Union (EU) finalised a landmark Free Trade Agreement (FTA), also touted as the “mother of all deals.” And shortly after, India made the trade breakthrough with the United States (US) after months of back-and-forth of negotiations. These two deals together mark a seismic shift for the Indian economy as well as the global trade by creating a multi-trillion dollar economic vista.

India and EU FTA

Nearly a decade in the making, the India EU FTA brings an unprecedented market access for both the regions. The agreement brings the two markets much closer through tariff liberalisation, market access, and also sets a strong foundation for technological cooperation.