Weekly Startup Funding Roundup: Emergent, Juspay, Unbox Robotics Lead Deals

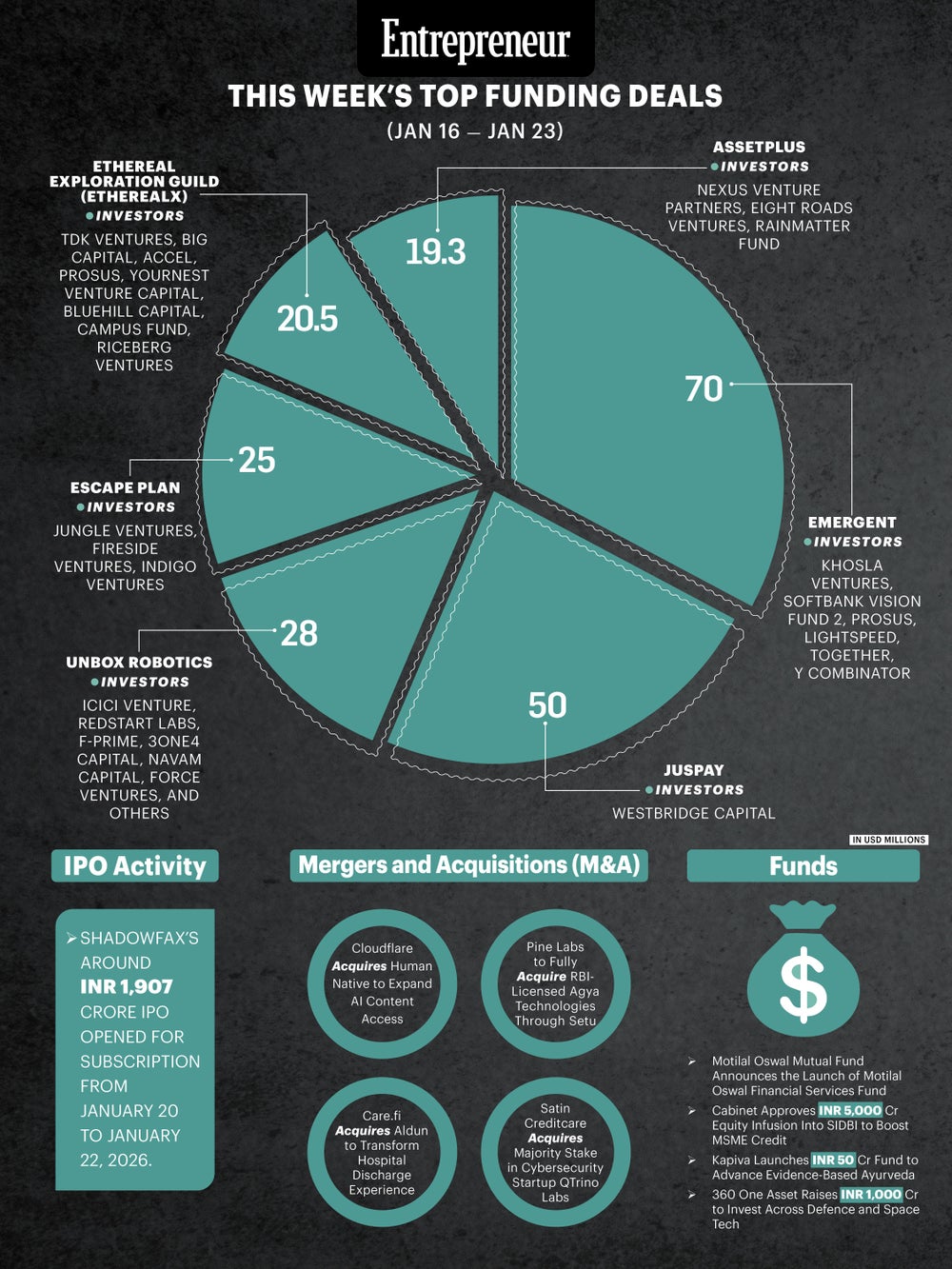

Funding announcements and deal activity tracked during the period from January 16 to January 23.

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

The past week saw steady deal activity across the global startup landscape, with companies spanning AI, fintech, logistics automation, consumer brands, spacetech, and wealth management announcing fresh capital raises.

Investors continued to back both early-stage and growth-stage ventures, while strategic acquisitions, new fund launches, and developments on the IPO front highlighted ongoing consolidation and long-term bets across technology-driven sectors.

This Week’s Top Funding Deals (Jan 16- Jan 23)

Emergent (AI Software Development Platform)

Emergent is an AI-native platform that enables users to build, test, and deploy full-stack web and mobile applications using autonomous AI agents. The subscription-based system manages coding, UI, backend logic, databases, APIs, servers, payments, and scalability, allowing non-technical users to create production-ready applications rapidly.

• Inception: 2025

• Founders: Mukund Jha and Madhav Jha

• Based-out: San Francisco (majority of team in Bengaluru)

• Funding Amount: USD 70 million

• Investors: Khosla Ventures, SoftBank Vision Fund 2, Prosus, Lightspeed, Together, Y Combinator

Juspay (Fintech)

Juspay builds payments infrastructure for enterprises and banks, offering products such as payment orchestration, checkout solutions, tokenisation, 3D secure authentication, real-time payments systems, and unified analytics. The company is also investing in AI-driven tools to enhance merchant experience and optimise internal operations.

• Inception: 2012

• Founders: Vimal Kumar, Sheetal Lalwani, Ramanathan RV, Magizhan Selvan

• Based-out: Bengaluru

• Funding Amount: USD 50 million

• Investor: WestBridge Capital

Unbox Robotics (Logistics Automation & Robotics)

Unbox Robotics focuses on automating warehouse and fulfilment operations through modular and scalable robotic solutions. Its AI-powered vertical robotic parcel sortation systems use proprietary swarm intelligence to improve efficiency, reduce space usage, and increase throughput for e-commerce and third-party logistics operators.

• Inception: 2019

• Founders: Pramod Ghadge and Shahid Memon

• Based-out: Pune

• Funding Amount: USD 28 million

• Investors: ICICI Venture, Redstart Labs, F-Prime, 3one4 Capital, Navam Capital, Force Ventures, and others

Escape Plan (Consumer Travel Products)

Escape Plan (Consumer Travel Products)

Escape Plan operates as a travel products platform catering to modern Indian travellers. The company designs and curates luggage, travel accessories, and mobility solutions across multiple use cases, distributing products through online marketplaces, direct-to-consumer channels, and a growing offline retail presence.

• Inception: 2025

• Founders: Abhinav Pathak and Abhinav Zutshi

• Based-out: Bengaluru

• Funding Amount: USD 25 million

• Investors: Jungle Ventures, Fireside Ventures, IndiGo Ventures

Ethereal Exploration Guild – EtherealX (Spacetech)

EtherealX is developing a medium-lift launch vehicle designed to carry heavy payloads into orbit. Its Razor Crest Mk-1 vehicle is expected to place up to eight tonnes into low Earth orbit and support missions to geostationary transfer and trans-lunar injection orbits.

• Inception: 2022

• Founders: Manu J Nair, Shubhayu Sardar, Prashanth Sharma

• Based-out: Bengaluru

• Funding Amount: USD 20.5 million

• Investors: TDK Ventures, BIG Capital, Accel, Prosus, YourNest Venture Capital, BlueHill Capital, Campus Fund, Riceberg Ventures

AssetPlus (Wealthtech & Financial Distribution)

AssetPlus provides a digital platform that enables mutual fund distributors and investors to manage investments through technology-led workflows. The platform supports mutual fund investing, ONDC integration, AI-driven advisory tools, and has expanded into insurance, fixed deposits, and retirement-focused products.

• Inception: 2016

• Founders: Vishranth Suresh and Awanish Raj

• Based-out: Chennai

• Funding Amount: USD 19.3 million

• Investors: Nexus Venture Partners, Eight Roads Ventures, Rainmatter Fund

Mergers and Acquisitions

The week also recorded strategic consolidation across sectors. Cloudflare acquired Human Native to expand AI-driven content access capabilities. Pine Labs announced plans to fully acquire RBI-licensed Agya Technologies through its subsidiary Setu. Healthcare fintech Care.fi acquired Aldun to streamline hospital discharge experiences, while Satin Creditcare picked up a majority stake in cybersecurity startup QTrino Labs.

Funds

On the fund side, Motilal Oswal Mutual Fund launched the Motilal Oswal Financial Services Fund. The Union Cabinet approved an INR 5,000 crore equity infusion into SIDBI to boost MSME credit. Kapiva launched a INR 50 crore fund focused on evidence-based Ayurveda, while 360 One Asset raised INR 1,000 crore to invest across defence and spacetech ventures.

IPO

Logistics startup Shadowfax’s IPO, sized at approx. INR 1,907 crore, opened for subscription between January 20 and January 22, 2026.

The past week saw steady deal activity across the global startup landscape, with companies spanning AI, fintech, logistics automation, consumer brands, spacetech, and wealth management announcing fresh capital raises.

Investors continued to back both early-stage and growth-stage ventures, while strategic acquisitions, new fund launches, and developments on the IPO front highlighted ongoing consolidation and long-term bets across technology-driven sectors.

This Week’s Top Funding Deals (Jan 16- Jan 23)

Emergent (AI Software Development Platform)

Emergent is an AI-native platform that enables users to build, test, and deploy full-stack web and mobile applications using autonomous AI agents. The subscription-based system manages coding, UI, backend logic, databases, APIs, servers, payments, and scalability, allowing non-technical users to create production-ready applications rapidly.