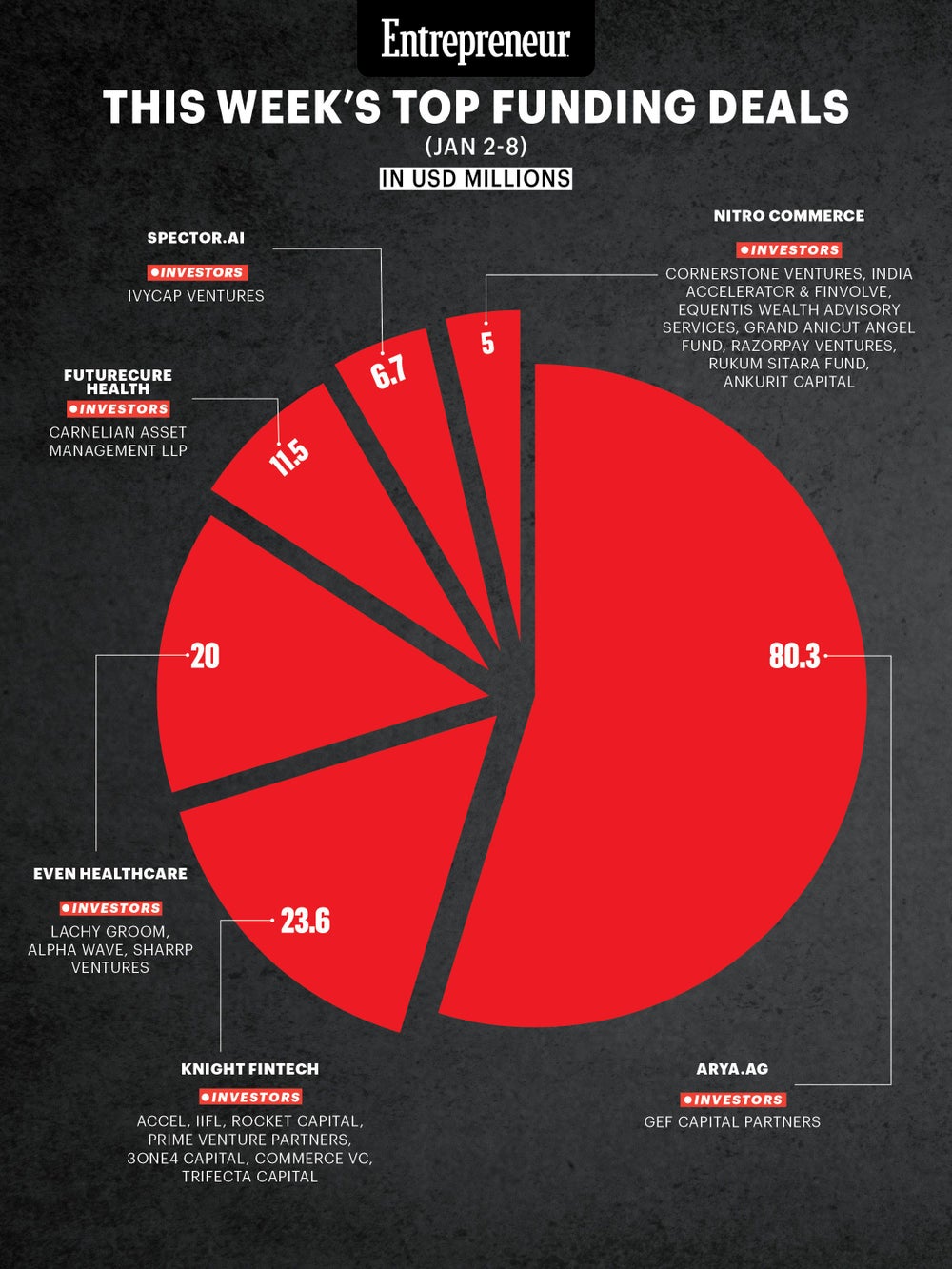

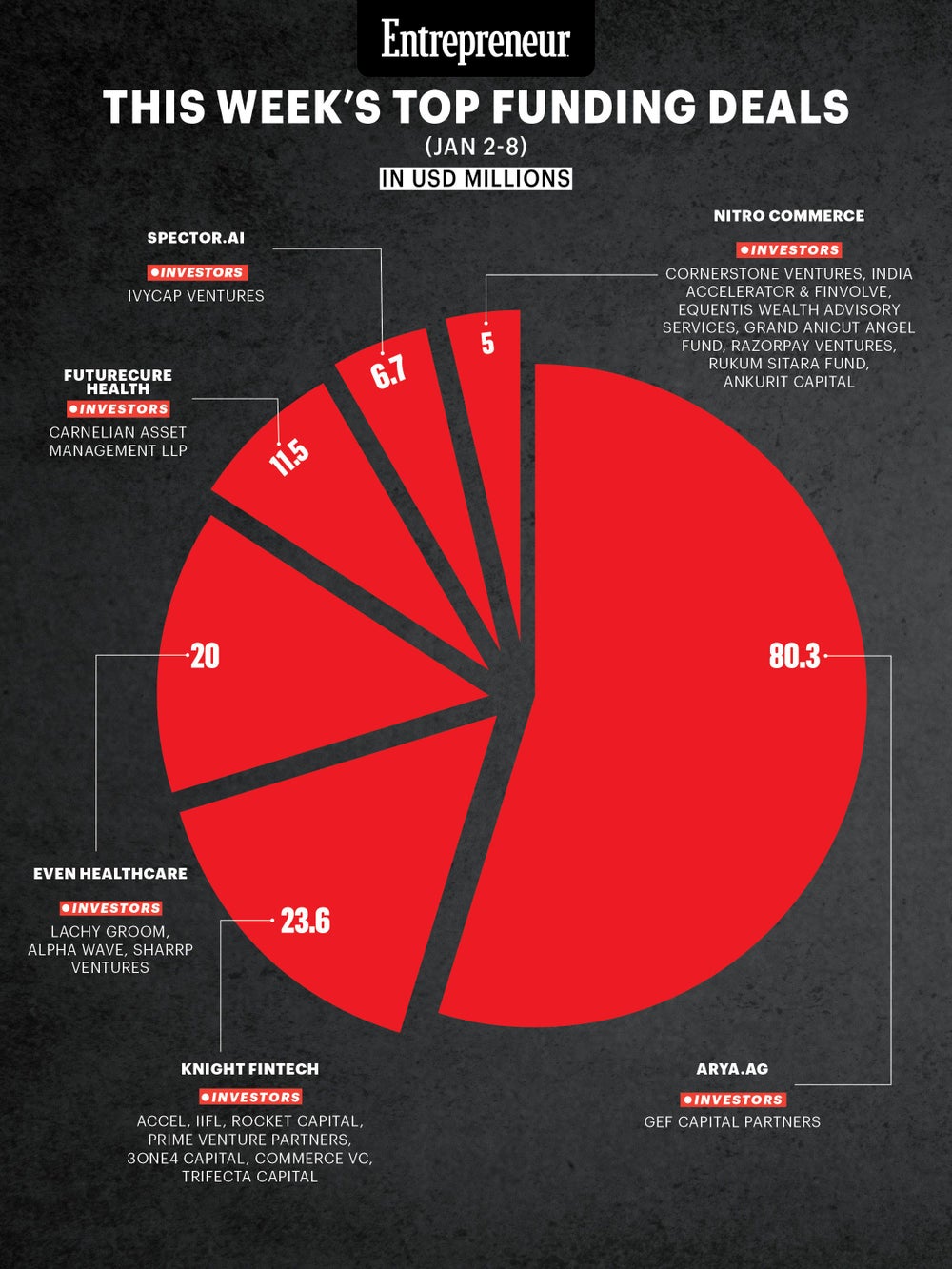

Weekly Funding Wrap: Arya.ag, Knight FinTech Lead the Funding Chart This Week

Top Startup Funding Deals of January 2–8

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

Startup funding activity in India moderated during the first full week of the new year, reflecting a cautious investment environment across the ecosystem. While overall deal momentum softened, capital continued to flow into startups addressing core sectors such as agriculture, healthcare, financial infrastructure, industrial technology and e-commerce enablement.

The week’s prominent funding rounds underline investor focus on platforms that improve operational efficiency, expand access to services, and apply technology to large, underserved markets.

Arya.ag (Agritech)

Arya.ag operates an integrated grain commerce platform that supports farmers and agri-enterprises across the pre/post-harvest lifecycle. Its services include pre-harvest advisory, scientific storage, collateral management, financing, and structured trade. By leveraging farm-level data and its warehousing network, the company enables farmers to choose optimal timing and channels to sell their produce, helping improve price discovery and reduce wastage.

• Inception: 2013

• Based-out: New Delhi

• Founders: Prasanna Rao, Anand Chandra, Chattanathan Devarajan

• Funding Amount: USD 80.3 million

• Investors: GEF Capital Partners

Knight FinTech (Fintech Infrastructure)

Knight FinTech provides digital infrastructure for banks, non-banking financial companies and fintech firms. Its platforms support co-lending, digital lending, embedded finance, supply chain finance and treasury operations. By acting as a bridge between surplus capital with banks and loan demand generated by fintechs and NBFCs, the company aims to reduce operational friction, improve risk management and enable more efficient capital deployment.

• Inception: 2019

• Based-out: Mumbai

• Founders: Kushal Rastogi, Parthesh Shah

• Funding Amount: USD 23.6 million

• Investors: Accel, IIFL, Rocket Capital, Prime Venture Partners, 3one4 Capital, Commerce VC, Trifecta Capital

Even Healthcare (HealthTech)

Even Healthcare (HealthTech)

Even Healthcare operates a vertically integrated managed-care model focused on preventive and outcome-driven healthcare. Through a membership-based approach, the startup offers free consultations, diagnostic tests and cashless hospitalisation. Its integrated “payvider” model combines healthcare delivery and financing, aiming to reduce overall costs while improving access to quality care and long-term health outcomes for members.

• Inception: 2020

• Based-out: Bengaluru

• Founders: Mayank Banerjee, Matilde Giglio, Alessandro Ialongo

• Funding Amount: USD 20 million

• Investors: Lachy Groom, Alpha Wave, Sharrp Ventures

FutureCure Health (HealthTech)

FutureCure Health focuses on technology-led care for chronic conditions such as vertigo, dizziness, migraine and tinnitus. Through its wholly owned subsidiary, NeuroEquilibrium, the company operates a network of diagnostic and rehabilitation clinics that follow a root-cause approach to treatment. It works closely with hospitals, ENT clinics and neurology centres to improve diagnostic accuracy and long-term patient outcomes.

• Inception: 2019

• Based-out: Jaipur

• Founders: Rajneesh Bhandari, Anita Bhandari

• Funding Amount: USD 11.5 million

• Investors: Carnelian Asset Management LLP

Spector.ai (Industrial AI)

Spector.ai builds AI-powered reliability and performance agents for asset-intensive industries including oil and gas, chemicals, manufacturing, utilities and automotive. Its platform combines industrial domain expertise with diagnostics, root-cause analysis and prescriptive insights, enabling enterprises to move towards proactive maintenance, improve uptime, optimise energy efficiency and reduce lifecycle costs of critical assets.

• Inception: 2024

• Based-out: US (headquarters) and Bengaluru (engineering base)

• Founders: Prashant Nedungadi, Sukrit Goel

• Funding Amount: USD 6.7 million

• Investors: IvyCap Ventures

Nitro Commerce (E-commerce & Marketing Technology)

Nitro Commerce operates an AI-driven marketing automation platform for e-commerce and D2C brands. It offers tools for storefront management, identity resolution, advertising, rewards and analytics through products such as NitroX and Nitro Ads. The platform focuses on privacy-first, intent-based targeting to help brands manage rising acquisition costs and improve cross-channel performance.

• Inception: 2023

• Based-out: Gurugram

• Founders: Umair Mohammad, Shamail Tayyab, Pratik Anand

• Funding Amount: USD 5 million

• Investors: Cornerstone Ventures, India Accelerator & Finvolve, Equentis Wealth Advisory Services, Grand Anicut Angel Fund, Razorpay Ventures, Rukum Sitara Fund, Ankurit Capital

According to Tracxn, overall startup funding during the week declined by around 36 percent compared to the previous week, reflecting a measured start to the year despite continued deal activity across multiple sectors.

Startup funding activity in India moderated during the first full week of the new year, reflecting a cautious investment environment across the ecosystem. While overall deal momentum softened, capital continued to flow into startups addressing core sectors such as agriculture, healthcare, financial infrastructure, industrial technology and e-commerce enablement.

The week’s prominent funding rounds underline investor focus on platforms that improve operational efficiency, expand access to services, and apply technology to large, underserved markets.

Arya.ag (Agritech)

Arya.ag operates an integrated grain commerce platform that supports farmers and agri-enterprises across the pre/post-harvest lifecycle. Its services include pre-harvest advisory, scientific storage, collateral management, financing, and structured trade. By leveraging farm-level data and its warehousing network, the company enables farmers to choose optimal timing and channels to sell their produce, helping improve price discovery and reduce wastage.

• Inception: 2013

• Based-out: New Delhi

• Founders: Prasanna Rao, Anand Chandra, Chattanathan Devarajan

• Funding Amount: USD 80.3 million

• Investors: GEF Capital Partners

Knight FinTech (Fintech Infrastructure)

Knight FinTech provides digital infrastructure for banks, non-banking financial companies and fintech firms. Its platforms support co-lending, digital lending, embedded finance, supply chain finance and treasury operations. By acting as a bridge between surplus capital with banks and loan demand generated by fintechs and NBFCs, the company aims to reduce operational friction, improve risk management and enable more efficient capital deployment.

• Inception: 2019

• Based-out: Mumbai

• Founders: Kushal Rastogi, Parthesh Shah

• Funding Amount: USD 23.6 million

• Investors: Accel, IIFL, Rocket Capital, Prime Venture Partners, 3one4 Capital, Commerce VC, Trifecta Capital

Even Healthcare (HealthTech)

Even Healthcare (HealthTech)

Even Healthcare operates a vertically integrated managed-care model focused on preventive and outcome-driven healthcare. Through a membership-based approach, the startup offers free consultations, diagnostic tests and cashless hospitalisation. Its integrated “payvider” model combines healthcare delivery and financing, aiming to reduce overall costs while improving access to quality care and long-term health outcomes for members.

• Inception: 2020

• Based-out: Bengaluru

• Founders: Mayank Banerjee, Matilde Giglio, Alessandro Ialongo

• Funding Amount: USD 20 million

• Investors: Lachy Groom, Alpha Wave, Sharrp Ventures

FutureCure Health (HealthTech)

FutureCure Health focuses on technology-led care for chronic conditions such as vertigo, dizziness, migraine and tinnitus. Through its wholly owned subsidiary, NeuroEquilibrium, the company operates a network of diagnostic and rehabilitation clinics that follow a root-cause approach to treatment. It works closely with hospitals, ENT clinics and neurology centres to improve diagnostic accuracy and long-term patient outcomes.

• Inception: 2019

• Based-out: Jaipur

• Founders: Rajneesh Bhandari, Anita Bhandari

• Funding Amount: USD 11.5 million

• Investors: Carnelian Asset Management LLP

Spector.ai (Industrial AI)

Spector.ai builds AI-powered reliability and performance agents for asset-intensive industries including oil and gas, chemicals, manufacturing, utilities and automotive. Its platform combines industrial domain expertise with diagnostics, root-cause analysis and prescriptive insights, enabling enterprises to move towards proactive maintenance, improve uptime, optimise energy efficiency and reduce lifecycle costs of critical assets.

• Inception: 2024

• Based-out: US (headquarters) and Bengaluru (engineering base)

• Founders: Prashant Nedungadi, Sukrit Goel

• Funding Amount: USD 6.7 million

• Investors: IvyCap Ventures

Nitro Commerce (E-commerce & Marketing Technology)

Nitro Commerce operates an AI-driven marketing automation platform for e-commerce and D2C brands. It offers tools for storefront management, identity resolution, advertising, rewards and analytics through products such as NitroX and Nitro Ads. The platform focuses on privacy-first, intent-based targeting to help brands manage rising acquisition costs and improve cross-channel performance.

• Inception: 2023

• Based-out: Gurugram

• Founders: Umair Mohammad, Shamail Tayyab, Pratik Anand

• Funding Amount: USD 5 million

• Investors: Cornerstone Ventures, India Accelerator & Finvolve, Equentis Wealth Advisory Services, Grand Anicut Angel Fund, Razorpay Ventures, Rukum Sitara Fund, Ankurit Capital

According to Tracxn, overall startup funding during the week declined by around 36 percent compared to the previous week, reflecting a measured start to the year despite continued deal activity across multiple sectors.