Easy Home Finance, The Guild, 4baseCare Among Top Funded Startups This Week

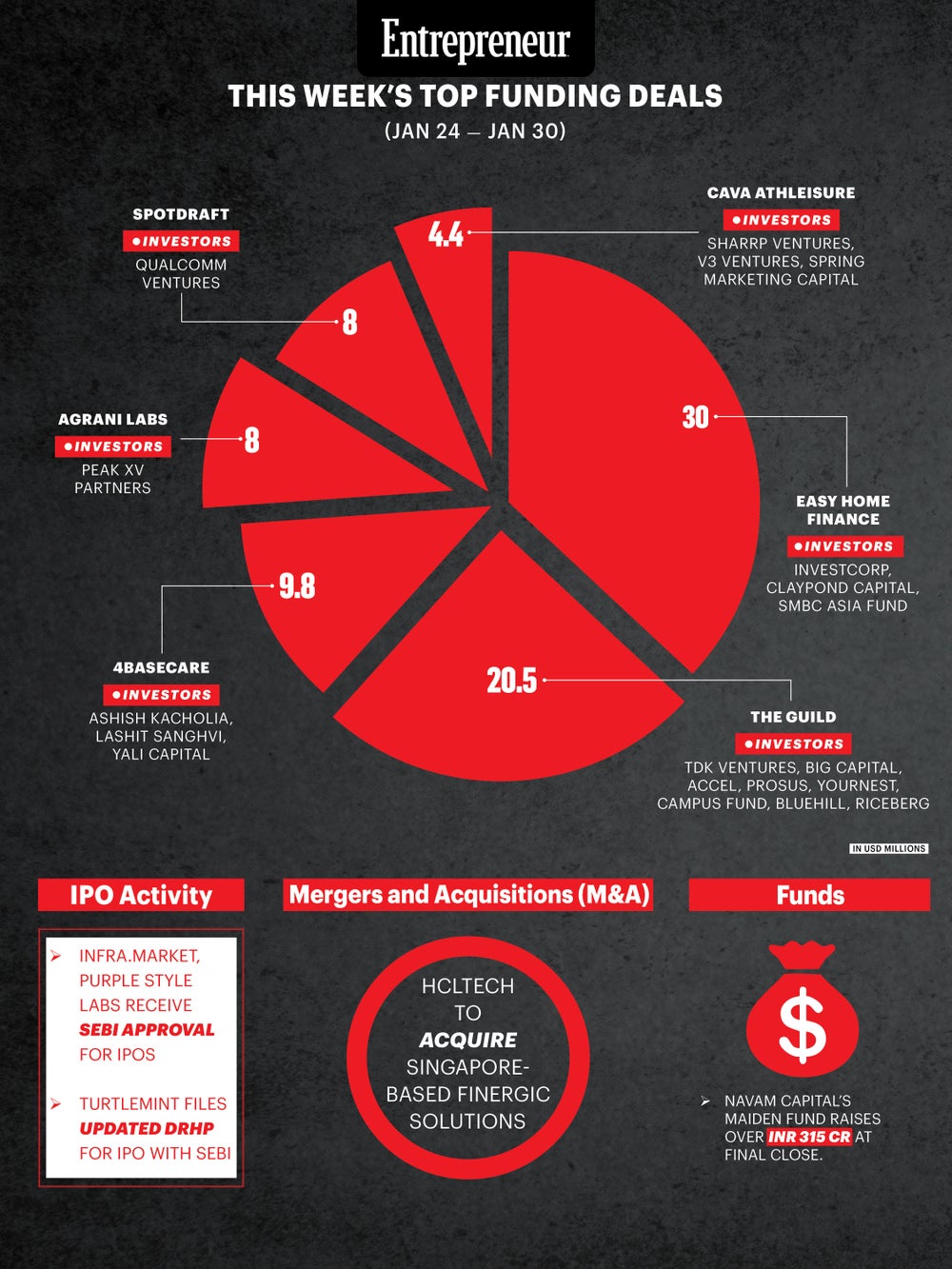

Top Deals of January 24-30

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

Overall venture funding momentum softened sharply during the week, reflecting a broader cooling trend in capital deployment. According to Tracxn, overall funding activity declined by around 72 percent compared to the previous week of December 16 to December 23, 2025.

Despite the slowdown, several startups across fintech, spacetech, healthtech, deeptech, SaaS, and consumer brands managed to close notable rounds, alongside key developments in mergers, fund activity, and IPO pipelines between Jan 24 and Jan 30.

Easy Home Finance (Housing Finance, Fintech)

Easy Home Finance focuses on simplifying access to home loans for middle income borrowers through a technology driven approach. By reducing paperwork and improving approval timelines, the company delivers mortgage backed loans through a largely digital process. Its model aims to bridge credit gaps in housing finance by combining underwriting discipline with streamlined customer experience.

• Inception: 2017

• Headquartered: Mumbai

• Founders: Rohit Chokhani and Hrishikesh Gandhi

• Funding Amount: USD 30 Million

• Investors: Investcorp, Claypond Capital, SMBC Asia Fund

The Guild formerly EtherealX (Spacetech, Launch Vehicles)

The Guild, earlier known as EtherealX, is working on developing fully reusable medium lift launch vehicles to reduce the cost of space transportation. Its flagship program, Razor Crest Mk 1, targets full reusability of both booster and upper stages. The company plans a technology demonstrator flight in 2027, followed by commercial missions in 2028.

• Inception: 2022

• Headquartered: Bengaluru

• Founders: Manu J Nair, Shubhayu Sardar, Prashanth Sharma

• Funding Amount: USD 20.5 Million

• Investors: TDK Ventures, BIG Capital, Accel, Prosus, Yournest, Campus Fund, BlueHill, Riceberg

4baseCare (Healthtech, Precision Oncology)

4baseCare operates in the precision oncology space, focusing on genomic testing and AI driven diagnostics tailored to Asian populations. The company develops personalised cancer care solutions using advanced genomic tools and data analytics. Its approach aims to improve treatment accuracy by aligning diagnostics with population specific genetic profiles.

• Inception: 2018

• Headquartered: Bengaluru

• Founders: Hitesh Goswami and Kshitij Rishi

• Funding Amount: USD 9.8 Mn

• Investors: Ashish Kacholia, Lashit Sanghvi, Yali Capital

Agrani Labs (AI Semiconductors, Deeptech)

Agrani Labs (AI Semiconductors, Deeptech)

Agrani Labs is building full stack AI compute platforms designed to strengthen India’s semiconductor ecosystem. The startup develops high performance data center GPUs along with proprietary software such as compilers and libraries. Its work focuses on enabling scalable AI workloads while reducing reliance on imported hardware technologies.

• Inception: 2024

• Headquartered: Bengaluru

• Founders: Dheemanth Nagaraj, Ashok Jagannathan, Srikanth Nimmagadda, Rajesh Vivekanandham

• Funding Amount: USD 8 Million

• Investor: Peak XV Partners

SpotDraft (Legal Tech, SaaS)

SpotDraft provides AI powered contract lifecycle management solutions for enterprises. Its platform covers automated contract drafting, AI driven review through VerifAI, e signatures, repository management, and analytics. By digitizing legal workflows, the company seeks to reduce contract turnaround time and improve compliance visibility for businesses.

• Inception: 2017

• Headquartered: Bengaluru

• Founders: Shashank Bijapur and Madhav Bhagat

• Funding Amount: USD 8 Million

• Investors: Qualcomm Ventures

Cava Athleisure (D2C, Consumer Brand)

Cava Athleisure operates as a direct to consumer brand focused on sustainable loungewear and activewear. Targeting Gen Z and millennial consumers, the brand offers joggers, tops, and hoodies made using eco conscious fabrics. Its in house production model emphasises versatility for both workouts and everyday use.

• Inception: 2022

• Headquartered: Bengaluru

• Founders: Ria Mittal and Shreya Mittal

• Funding Amount: USD 4.4 Million

• Investors: Sharrp Ventures, V3 Ventures, Spring Marketing Capital

Mergers and Acquisitions

In the mergers and acquisitions space, HCLTech announced its plans to acquire Singapore based Finergic Solutions. The acquisition is expected to strengthen HCLTech’s capabilities in digital platforms for the financial services sector, particularly in areas such as wealth management and data driven solutions.

Funds

Navam Capital marked a significant milestone with the final close of its maiden fund, raising over INR 315 crore. The fund is expected to focus on growth stage investments, adding to the pool of domestic capital supporting Indian startups.

IPO Activities

On the public markets front, Infra.Market and Purple Style Labs received approval from SEBI to proceed with their initial public offerings. Meanwhile, Turtlemint filed an updated draft red herring prospectus with SEBI, signaling continued intent among new age companies to tap public markets.

Overall venture funding momentum softened sharply during the week, reflecting a broader cooling trend in capital deployment. According to Tracxn, overall funding activity declined by around 72 percent compared to the previous week of December 16 to December 23, 2025.

Despite the slowdown, several startups across fintech, spacetech, healthtech, deeptech, SaaS, and consumer brands managed to close notable rounds, alongside key developments in mergers, fund activity, and IPO pipelines between Jan 24 and Jan 30.

Easy Home Finance (Housing Finance, Fintech)

Easy Home Finance focuses on simplifying access to home loans for middle income borrowers through a technology driven approach. By reducing paperwork and improving approval timelines, the company delivers mortgage backed loans through a largely digital process. Its model aims to bridge credit gaps in housing finance by combining underwriting discipline with streamlined customer experience.