This Week’s Top Funding Deals: Big Bets on Mobility, Food, Space and Commerce (Feb 1–Feb 6)

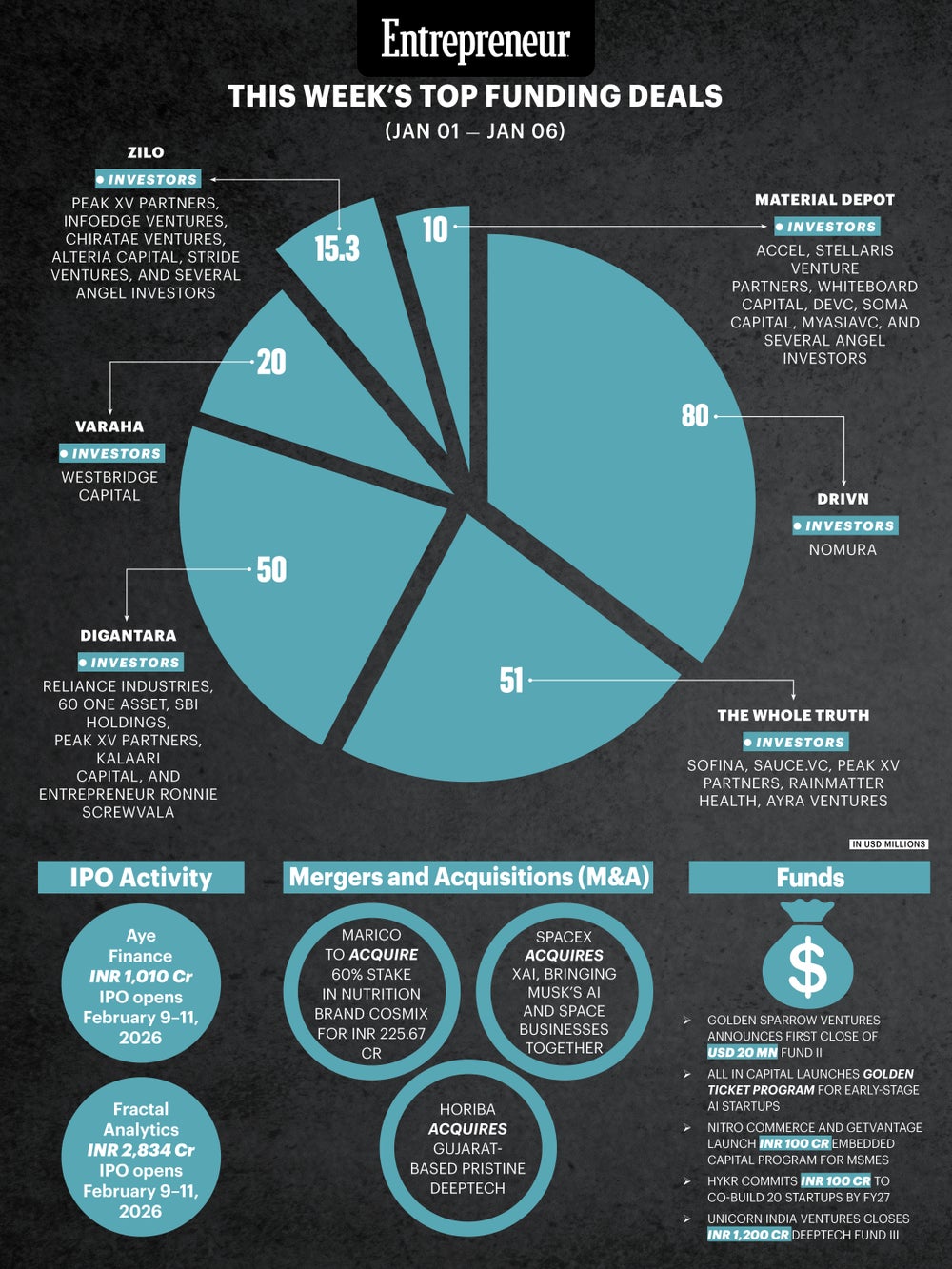

The week’s top-funded startups included Drivn, The Whole Truth, Digantara, Varaha, ZILO, and Material Depot, spanning mobility, food, spacetech, climate, quick commerce, and home interiors.

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

India’s startup ecosystem saw steady investment activity between February 1 and February 6, with funding flowing into sectors such as electric mobility, packaged foods, spacetech, climate solutions, quick commerce, and home interiors. The week featured a mix of large strategic investments and early-stage raises, alongside notable mergers and acquisitions, new fund launches, and a busy IPO pipeline, reflecting continued momentum across the venture landscape.

Top Funding Deals

Drivn (Electric Mobility)

Drivn is a full-stack electric mobility platform focused on large commercial vehicles such as buses and heavy trucks. It acquires, owns, and leases EV fleets while offering integrated services including charging infrastructure planning, fleet operations, and battery lifecycle management. Drivn targets inter-city transport and heavy trucking, helping enterprises cut Scope 3 emissions across hard-to-abate sectors like logistics, cement, and steel.

• Inception: 2025

• Headquartered: Gurugram

• Founders: Manav Bansal and Alpna Jain

• Funding Amount: USD 80 Million

• Investors: Nomura

The Whole Truth (Packaged Foods)

The Whole Truth operates in the clean-label packaged foods space, offering protein bars, protein powders, nut butters, dark chocolates, and muesli. Built on radical transparency, the brand avoids artificial additives and hidden sugars. It sells through its D2C platform, quick-commerce channels, and offline retail, catering to India’s growing health-conscious consumer base.

• Inception: 2019

• Headquartered: Mumbai

• Founders: Shashank Mehta

• Funding Amount: USD 51 Million

• Investors: Sofina, Sauce.vc, Peak XV Partners, Rainmatter Health, Ayra Ventures

Digantara (Spacetech)

Digantara builds space-based and ground-based infrastructure for space situational awareness and security. Its AIRA platform combines sensing hardware, analytics, and data processing, while solutions like the SCOT constellation, ALBATROSS series, and SKYGATE ground network provide orbital monitoring and missile tracking capabilities for global clients.

• Inception: 2020

• Headquartered: Bengaluru

• Founders: Anirudh Sharma

• Funding Amount: USD 50 Million

• Investors: Reliance Industries, 60 One Asset, SBI Holdings, Peak XV Partners, Kalaari Capital, Ronnie Screwvala

Varaha (ClimateTech)

Varaha (ClimateTech)

Varaha focuses on nature-based carbon removal by working with smallholder farmers to implement regenerative agricultural practices. The company generates verifiable carbon removal credits using tech-enabled monitoring, measurement, and reporting platforms, ensuring transparency and credibility for global carbon markets.

• Inception: 2022

• Headquartered: Gurugram

• Founders: Madhur Jain, Ankita Garg, Vishal Kuchanur

• Funding Amount: USD 20 Million

• Investors: WestBridge Capital

ZILO (Fashion)

ZILO is a quick-commerce fashion startup enabling 60-minute delivery of apparel from over 200 brands. It offers home trials, instant returns, and AI-powered style recommendations. The company uses a hybrid model combining dark stores and brand partnerships to deliver curated fashion at speed.

• Inception: 2025

• Headquartered: Mumbai

• Founders: Padmakumar Pal and Bhavik Jhaveri

• Funding Amount: USD 15.3 Million

• Investors: Peak XV Partners, InfoEdge Ventures, Chiratae Ventures, Alteria Capital, Stride Ventures, angel investors

Material Depot (Home Interiors)

Material Depot is an omni-channel platform serving both B2B and B2C customers in the home interiors market. It offers curated materials such as tiles, laminates, and plywood, supported by 3D visualisation tools, sample ordering, and direct manufacturer sourcing through online channels and physical experience centres.

• Inception: 2022

• Headquartered: Bengaluru

• Founders: Manish Reddy and Sarthak Agrawal

• Funding Amount: USD 10 Million

• Investors: Accel, Stellaris Venture Partners, Whiteboard Capital, DeVC, Soma Capital, MyAsiaVC, angel investors

Mergers and Acquisitions (M&A)

During the week, Marico announced the acquisition of a 60% stake in nutrition brand Cosmix for INR 225.67 crore, strengthening its presence in the health and wellness segment. Globally, SpaceX acquired xAI, bringing Elon Musk’s AI and space ventures under one umbrella. Meanwhile, HORIBA acquired Gujarat-based Pristine Deeptech, expanding its deeptech and advanced instrumentation capabilities.

Fund Launches and Capital Programs

Several new funds and initiatives were announced this week. Golden Sparrow Ventures marked the first close of its USD 20 million Fund II, while All In Capital launched its Golden Ticket Program targeting early-stage AI startups. Nitro Commerce and GetVantage introduced a INR 100 crore embedded capital program for MSMEs, and HyKr committed INR 100 crore to co-build 20 startups by FY27. Additionally, Unicorn India Ventures closed its INR 1,200 crore Deeptech Fund III.

IPO Watch

The primary market is set for a busy week ahead. Aye Finance’s INR 1,010 crore IPO opens for subscription from February 9 to February 11, 2026, priced between INR 122 and INR 129 per share. Fractal Analytics will also launch its INR 2,834 crore IPO during the same period, with a price band of INR 857 to INR 900 per share, marking one of the largest tech listings of the year.

India’s startup ecosystem saw steady investment activity between February 1 and February 6, with funding flowing into sectors such as electric mobility, packaged foods, spacetech, climate solutions, quick commerce, and home interiors. The week featured a mix of large strategic investments and early-stage raises, alongside notable mergers and acquisitions, new fund launches, and a busy IPO pipeline, reflecting continued momentum across the venture landscape.

Top Funding Deals

Drivn (Electric Mobility)

Drivn is a full-stack electric mobility platform focused on large commercial vehicles such as buses and heavy trucks. It acquires, owns, and leases EV fleets while offering integrated services including charging infrastructure planning, fleet operations, and battery lifecycle management. Drivn targets inter-city transport and heavy trucking, helping enterprises cut Scope 3 emissions across hard-to-abate sectors like logistics, cement, and steel.

• Inception: 2025

• Headquartered: Gurugram

• Founders: Manav Bansal and Alpna Jain

• Funding Amount: USD 80 Million

• Investors: Nomura